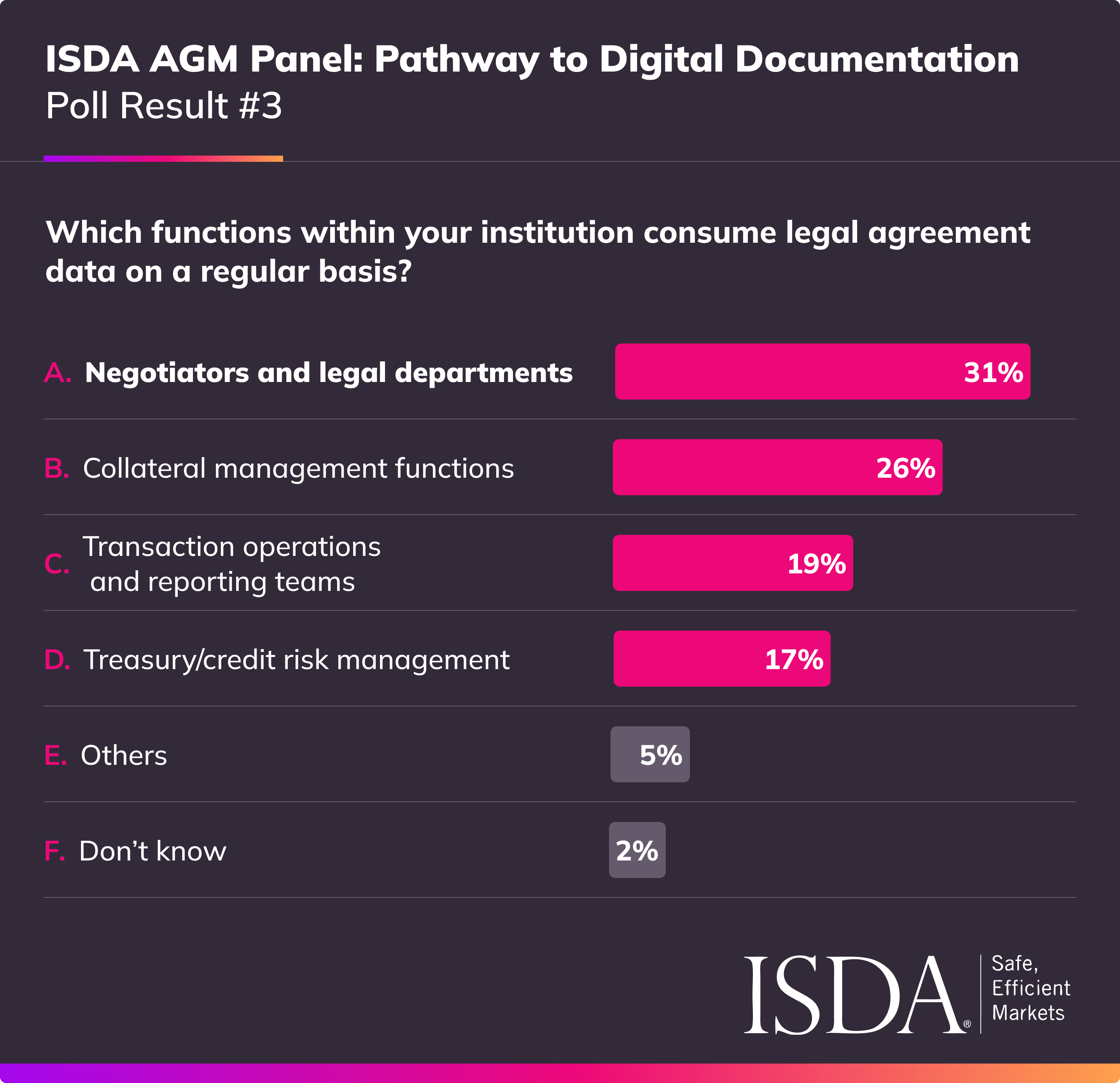

Polling conducted at the ISDA AGM conference sheds light on the critical role of legal agreement data within banking institutions. The results highlight the various functions that regularly consume this data, emphasizing the need for an efficient and integrated approach to managing ISDA agreements. In this thought leadership piece, we explore the value of implementing an Intelligent Document Processing (IDP) system for ISDA agreements across banking institutions and how it can drive operational efficiency, risk mitigation, and enhanced decision-making capabilities.

Unlocking the Value of Legal Agreement Data at Banks: Insights from a Recent Poll on IDP for ISDA Agreements

Unveiling the Key Consumers:

The poll findings indicate that negotiators and legal departments (31%) are the primary users of legal agreement data within banking institutions. Their reliance on accurate and up-to-date information is crucial for ensuring smooth negotiations and maintaining compliance with regulatory requirements. Following closely are collateral management functions (26%), transaction operations and reporting teams (19%), and treasury/credit risk management teams (17%). These teams heavily depend on legal agreement data for crucial functions such as collateral optimization, trade reporting, and risk assessment. A significant percentage of respondents (9%) also cited other functions that consume legal agreement data, demonstrating its pervasive nature within the banking ecosystem.

These results illustrate the broad value and application of digitized agreement data throughout a banking institution. Nearly all departments and teams benefit from this information, indicating substantial value across the enterprise.

The Value of IDP for ISDA Agreements:

Enhanced Efficiency: Implementing an IDP solution for ISDA agreements enables banking institutions to automate the extraction and analysis of legal agreement data. By reducing manual efforts and streamlining processes, negotiators and legal departments can focus on value-added tasks, resulting in improved efficiency and faster turnaround times for agreements.

Risk Mitigation: Collateral management functions play a vital role in optimizing collateral usage and mitigating counterparty credit risk. IDP empowers these teams to extract relevant data from ISDA agreements promptly, facilitating accurate collateral valuation, monitoring, and reporting. This enables proactive risk management and ensures compliance with regulatory requirements.

Streamlined Operations and Reporting: Transaction operations and reporting teams require real-time access to legal agreement data for seamless transaction processing, accurate reporting, and timely reconciliation. IDP automates data extraction, providing these teams with the necessary information to execute transactions swiftly and generate comprehensive reports, leading to improved operational efficiency.

Empowering Treasury/Credit Risk Management: Treasury and credit risk management teams rely on legal agreement data to assess credit exposure, manage liquidity, and make informed investment decisions. IDP streamlines data access and analysis, enabling these teams to perform risk assessments more efficiently and respond promptly to market dynamics, ultimately enhancing the overall risk management framework.

For more information

Kinetix is leading the way in Smart Documentation solutions and Intelligent Document Processing (IDP), delivering AI-based services that transform data trapped in documentation into insights, while driving efficiency and reduced costs. For more information about Kinetix IDP, contact Mark Zurada at sales@kinetixtt.com.